MTD will affect every individual and every business which pays tax in the UK. It will change the way businesses keep their accounting records and report to HMRC.

Businesses will need to keep digital records and use compatible software to submit their VAT or Income Tax updates online.

From the 1st April 2019 businesses which are VAT registered will have to file their vat returns through their MTD software. Limited companies will join MTD from April 2020

If you are unsure as to whether MTD affects you or not, the following checklist will apply:

- Are you above the VAT threshold of £85 000?

- Are you likely to be VAT registered in the next 12-24 months?

- Are you a limited company?

Before you sign up, you must have software that:

- Allows you to submit VAT Returns

- Is compatible with Making Tax Digital for VAT

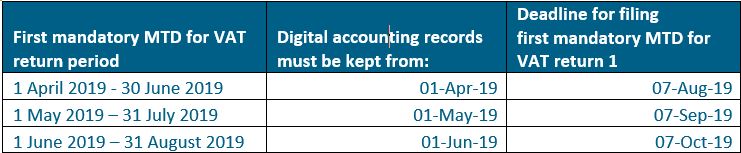

If you do sign up for Making Tax Digital for VAT, you are required to do so at least one week before your VAT Return is due. Below are the dates for VAT return submissions after the roll out:

This article was written by:

Gail Kruger, Process Facilitator & Xero Partner, Grow With Vision Ltd

www.growithvision.com

Got a business question?

We're here to help. Get in touch.

Book your free appointment below: