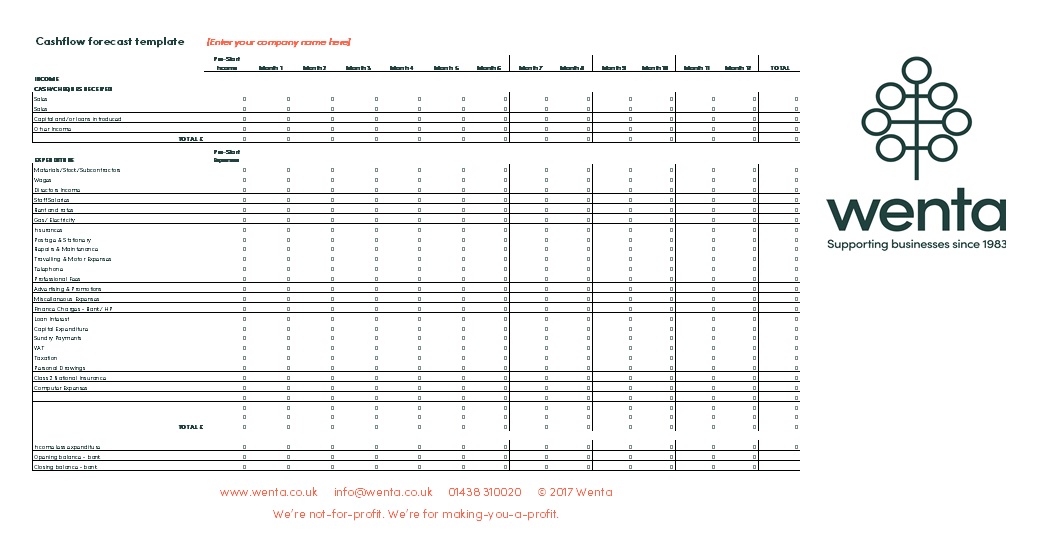

Free Cashflow Forecast Template

5 min readWhat is a cash flow forecast?

A cash flow forecast is an estimate of the amount of money you expect your business to take in and pay out over a period of time, including all your projected income and expenses.

Think of it as a 'snapshot in time' - a way to record 'when the bill will be paid' - that should reflect outgoings (actual costs to your venture) on a month-by-month basis. Some things are paid for monthly, some quarterly, a few once a year, others just one-time purchases.

The difference between sales (income/revenue) projections and the overheads is shown either as a positive figure or a shortfall. A spreadsheet should therefore indicate totals that match your opening and closing bank balance each month, to track 'cash flow' in and out of your account.

A forecast normally covers the next 12 month period, however, it can sometimes cover shorter terms such as a week or month. It helps you to understand how sustainable your plans are and allows you to predict the future financial performance of your business.

A cashflow forecast helps to work out viability in terms of how much cash (liquidity) will be in a venture at a given stage. Ideally, you should ensure that you have enough cash to cover at least three months' outgoings if you had no sales. This is known as 'working capital'.

Download our free cashflow forecast template below.

Cashflow Forecast Template - Excel

If you need any help with completing your cashflow forecast, or have any questions, our business advisors can help.

Please note: a cashflow forecast is different to a Profit & Loss forecast. The latter format is configured to determine profitability, such as recording 'tax allowances' - entitlement amounts one may claim as part of tax return filing - that are not received as income nor shown on a cashflow forecast. As examples, 'Use of Home as Office' and 'Depreciation' (more accurately), 'Writing Down Allowance'.

To access our Profit & Loss template, please click here.

Call us

01438 310020

This article was revised and updated December 2022. Linked templates were revised and updated December 2022.