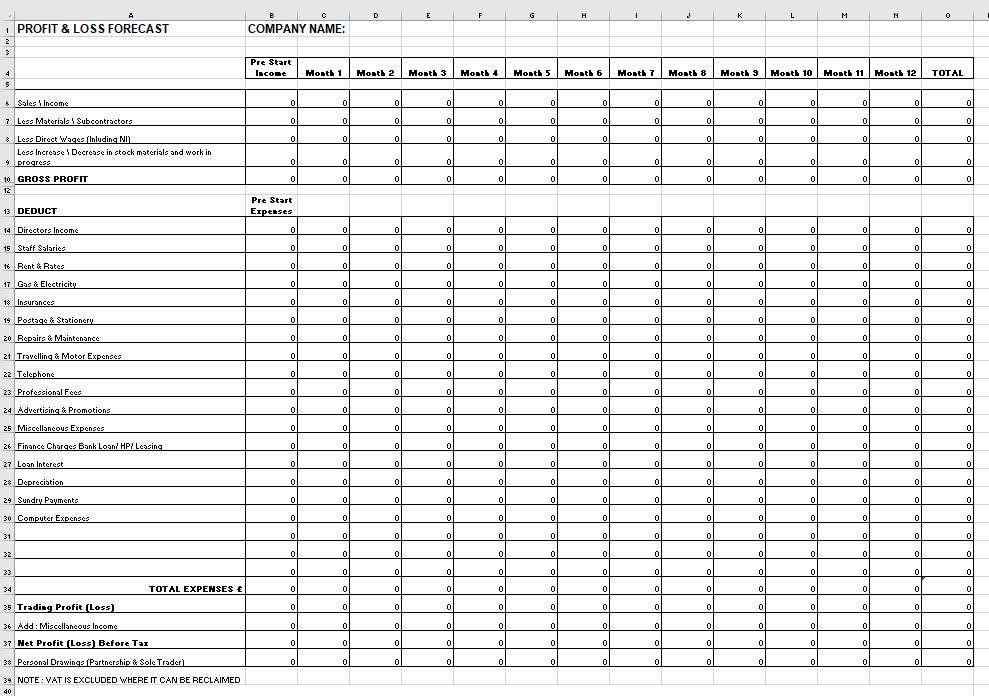

Profit and Loss Statement template

5 min readA profit and loss statement is a key document that limited companies need to produce to satisfy HMRC requirements.

If you're a sole trader, you are not obliged to complete one, or any formal accounts for tax purposes, however, you will need to 'keep adequate records to complete your self-assessment fully and accurately' and a profit and loss statement is vital for this and will give the sole trader a better understanding so that they can plan their tax payments for the future.

The profit and loss statement illustrates revenues and costs as well as how much profit has been made by the business over the period it has been prepared for (usually the last 12 months).

Anyone can prepare the statement although many business owners choose an accountant to ensure all financials are kept in order. The profit and loss statement is part of a general bookkeeping set made up also of the company balance sheet and cash flow forecast.

General headings include:

- gross profit

- net profit

- operation profit

- profit before tax

We've put together the below useful template for you to download and use:

Business Advisor recommendation:

“As tax is now paid 6 months in advance, it would be prudent to also have a running cashflow forecast."”

Raj Raithatha, Wenta 2020

Need more help working through the content mentioned in this article?

Got a business question?

We're here to help. Get in touch.

Book your free appointment below: